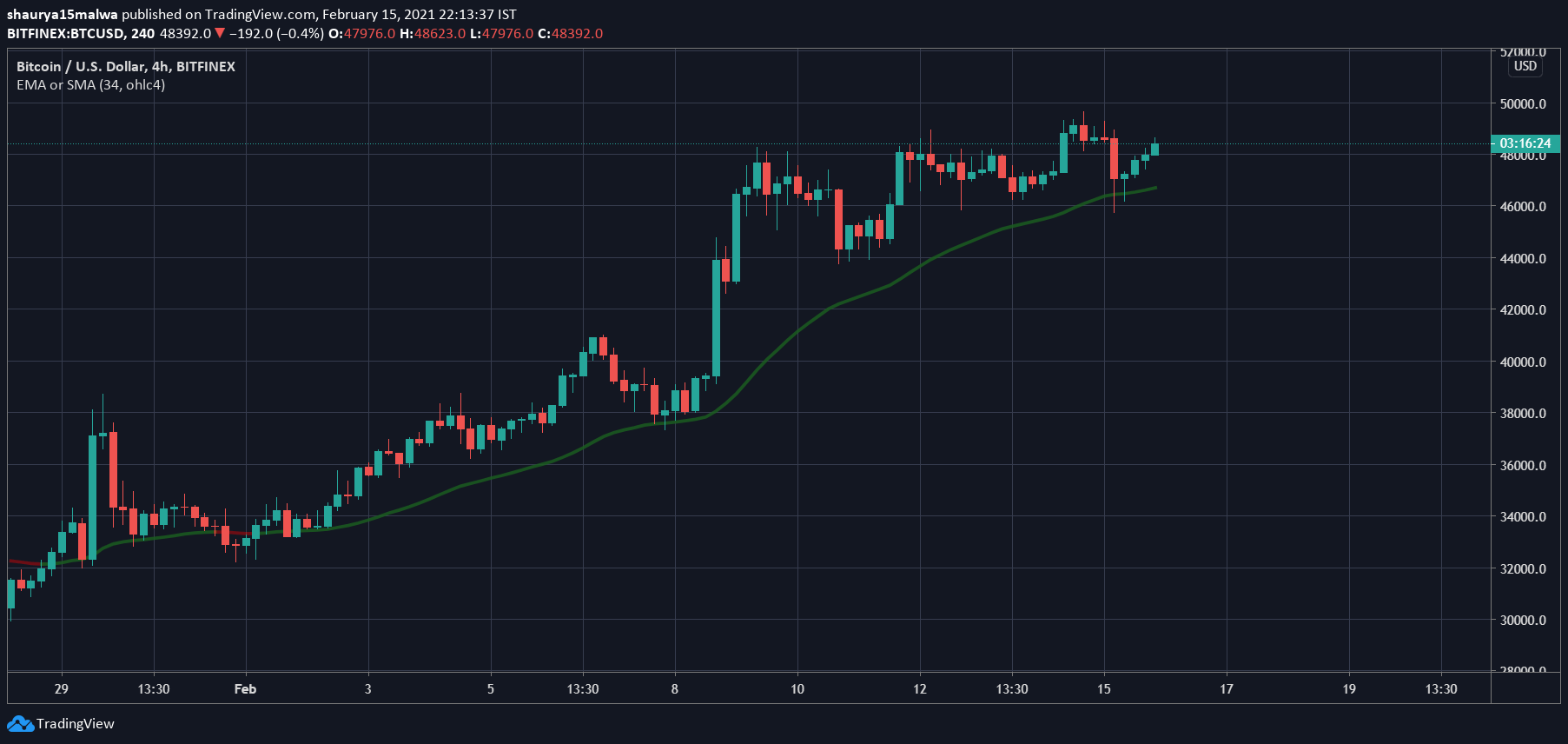

The market cleaned out overleveraged traders in a sudden move downwards yesterday before recovering in the afternoon hours on Monday.

Altcoin traders lost over $1.7 billion in the past day as crypto markets took a hit on the back of high funding rates and overleveraged trading. Bitcoin dipped below $46,000 momentarily, while some altcoins fell over 40% in two days.

In last, 1 hour sum of $355M longs got liquidated across Bitcoin and the top 10 listed altcoins

Data comes from Binance Futures only

Overloads, freezes happened on both Binance Futures, FTX and Bybit pic.twitter.com/RWZmxagBgV— Krisma (@KRMA_0) February 15, 2021

Liquidations are a market term that describes the closing out of a losing position on an exchange. These happen when traders borrow in excess of their principal amount to place better bets for potentially bigger gains. When prices move against the intended direction, exchanges automatically close out these leveraged positions, and that trade is said to be “liquidated.”

Data from markets tool Bybt showed Bitcoin traders took a $500 million hit alone, with Ethereum traders losing over $300 million and XRP traders losing $74 million. Dogecoin speculators lost a fair bit as well—with $40 million in liquidations in the past day for the meme coin.

In the past 24 hours, 254,795 traders were liquidated, while the largest single liquidation occurred on crypto exchange Huobi after a BTC/USD valued at $21.25 million went the other way, Bybt showed.

Crypto exchange Binance saw over $800 million worth of liquidations, with 91% of those trades being “long” (betting on the market’s upside) positions. Huobi saw $300 million in liquidations, while Bybit and OKEx saw $236 million and $101 million respectively.

Bitfinex oversaw just $2.21 million in liquidations—the lowest among all major crypto exchanges.

Meanwhile, since the liquidations yesterday, crypto markets have seen a bit of green across the board. Bitcoin has risen to over $48,300 at press time, while the DeFi sector has surged strongly upwards after the sudden fall. “Blue chips” like Aave, Sushi, Uniswap, and Synthetix all rose over 10% at press time.

Despite the brutal liquidations, it was just another day at the office for most crypto traders.